The Finance Act 2020 came into force on 1st December 2020.

The Finance Act 2020 contains a number of changes relating to HM Revenue & Customs (HMRC) that will impact Directors in different ways.

We thought it would be helpful for us to highlight these changes and explain them in a bit more detail. You can also download a copy from here

What is changing?

Many years ago HMRC held a preferential status where they were paid ahead of most creditors. That all changed in September 2003 when the Enterprise Act abolished it. Since then, they have ranked equally with every other unsecured creditor.

Under the Finance Act 2020, HMRC have re-gained preferential status within personal and company insolvencies that commence after 1 December 2020 in relation to the following taxes:

- PAYE

- VAT

- Employee NICs

- Construction Industry Schemes

It is important to point out that all other company HMRC liabilities will remain as ordinary unsecured creditors, i.e. Corporation Tax and Employers NICs.

The Finance Act 2020 change does not affect Sole Traders in relation to their self-assessment tax, which will also remain as an ordinary unsecured creditor.

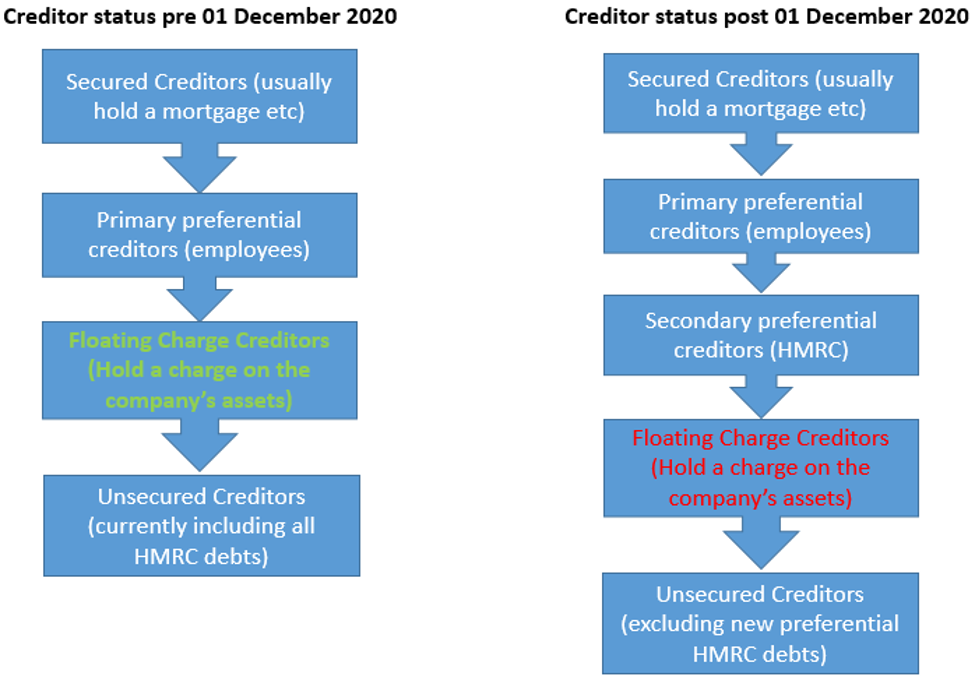

Here’s a high level visual display of the changes for ease of reference:

How does this impact your Company or you as a Director?

The Security of Floating Charge holders:

If a Company borrowed funds and granted a Floating Charge, that creditor holds security over the Company’s assets. Should anything occur which changes the Company’s ability to repay their debt, the creditor can take control of the assets and sell them to get their money back.

This provides the creditor holding the Floating Charge with comfort that their money is protected as they stand close to the top of the tree in terms of repayment. HMRC were previously ranked below them.

Under Finance Act 2020, from 1 December 2020 when certain HMRC debts became preferential, they climbed above the Floating Charge holder in the tree and will now get paid ahead of them, reducing the level of comfort that the Floating Charge creditor had in protecting their money.

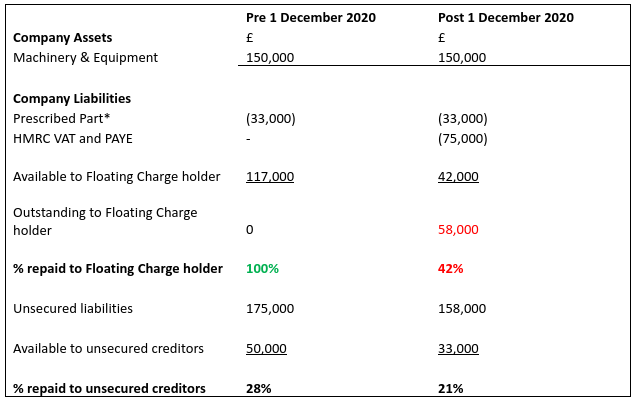

Below is an illustration of where the Floating Charge holder stood pre and post 1 December 2020 based on:

- The Floating Charge holder being owed £100,000

- HMRC being owed £75,000 in relation to outstanding VAT and PAYE

- Other unsecured creditors being owed £100,000.

* A % of Company assets set aside for unsecured creditors where a Floating Charge has been granted

As you can see in this example, after 1 December 2020, HMRC will receive 100% of the outstanding liability instead of 28%, and the Floating Charge holder will lose 46% of their lending. This may significantly change the way that these creditors act in the future.

Reduction or Withdrawal of borrowing.

To protect their financial standing, the creditor could request that the Company reduces its borrowing over a period of time. Whether this will be a long or short period would depend on the financial standing of the Company.

The creditor could, if their agreement allowed them to, remove the facility all together and ask for immediate repayment. Whilst this is unlikely as it could push the Company into an insolvent position, it is a possibility.

Planning ahead can reduce any potential issues and allow better negotiations with the Floating Charge holder, should they be required. It is important that a Director understands the financial position of the Company at all times so they can act accordingly when required.

Increased Personal Guarantees

As the security afforded to asset-based lenders will be reduced, they may either reduce the level of lending offered or not offer it at all, making it harder for Directors to locate funding.

If a Company is successful in obtaining asset-based lending, the lender may look for other ways to secure their debt, usually in the form of a Personal Guarantee from the Director.

A Personal Guarantee allows the lender to pursue the Director’s personal assets should the Company be unable to repay the amount owed. This exposes the Director to personally repay Company debts and puts their own assets at risk.

It is important that a Director seeks legal and financial advice when seeking funding and prior to signing any Personal Guarantee.

If you already have Personal Guarantees in place and you feel that they could be called upon in future, we would always suggest that you seek advice early to enable you to have a good understanding of the situation and how to navigate through it.

Insolvency Planning

If you feel like you or your Company might be impacted by any of the above, then seek professional advice early. HMRC may have a deciding vote on which options are available, especially if you are looking to continue trading.

What else is changing?

Joint and Several Liability of Company Directors.

The Finance Act 2020 has also provided HMRC with power to make Company Directors, Shadow Directors and certain others connected to a Company, jointly and severally liable for the Company’s tax liabilities. This will not relate to outstanding tax prior to 1 December 2020, only future liabilities.

This means if the Company fits the conditions, HMRC can not only chase the Company for the outstanding payment, but can now chase the Directors personally too – for the full amount outstanding. This could also put the Director’s personal assets at risk.

HMRC are only able to make the Director personally liable if the debt has arisen from tax avoidance, tax evasion or repeated insolvency.

When it comes to insolvency, there are certain conditions that must be met for the Director to become personally liable:

- The Director has been the Director of two companies in the past five years that have entered insolvency with outstanding HMRC debt.

- The Director is also a Director of a new Company that trades in the same or similar way as the previous companies.

- The total amount of debt owed to HMRC from the first two companies is over £10,000 and more than 50% of the total outstanding debt to unsecured creditors.

How does this Impact you as a Director?

This now means that a Company tax debt can become a personal liability for a Director.

All Directors have a duty to the Company, so even if you are one of a number of Directors and you don’t deal with the finances, you can still become personally liable for the full amount.

There will be a greater reliance on Directors to ensure their Company keeps up to date with paying their tax liabilities. That said, it is also very important you treat all creditors equally as preferring a certain creditor could also create a personal liability should the Company enter insolvency at a later date.

What now?

It might seem all doom and gloom, but it’s important that as a Director you are fully aware of the consequences of your actions, because if the Company does enter into an insolvency solution, these actions can be questioned for up to five years prior to insolvency.

At JT Maxwell, our overarching recommendation would be that if you have any concerns about your Company, whether it be big or small, seek professional advice and seek it early.

Contact us on using the form or call our offices on:

Lisburn: 02892 448112

Derbyshire: 01457 605 871

Lancashire: 01254 914702

You can access the full Finance Act 2020 on the government website at https://www.legislation.gov.uk/ukpga/2020/14/contents